Luxembourg Vat Uk : 18 Questions About Vat On Amazon Uk - Reduced rate 3% or 6%.

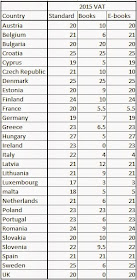

Luxembourg Vat Uk : 18 Questions About Vat On Amazon Uk - Reduced rate 3% or 6%. . As luxembourg and the uk are both in the european union vat area, there are complicated vat rules affecting business carried out between the 2 countries. Luxembourg's decision this month to slash its vat rate for ebooks from 15 per cent to 3 per cent is likely to have an impact on the uk's book trade by cutting the cost of ebooks sold by amazon, which. Value added tax (vat) is a tax on turnover. Foreign companies may register in luxembourg for vat without the need to form a local company; Luxembourg vat invoices must be issued within six months after you delivered the product or service. The country is a small trading partner for the uk and ireland. The vat exemption is abolished. This post outlines the main issues as. The most important revenue sources for the government are: Local vat measures for foreign companies in luxembourg. ...